Best Rolex, Patek Philippe and Audemars Piguet Watches for Men and Women in NYC

(212) 730-5959 / (888) 342-9949

5 Reasons Why Diamond Rings and Jewelry Are Recession-Proof Investments

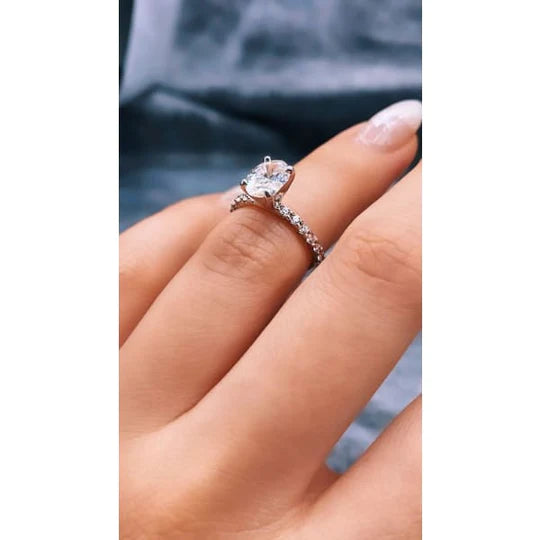

It seems counter-intuitive at first, but sales of luxury items such as diamond rings, luxury watches, and jewelry seem to increase during periods of economic downturn. If you are thinking about jewelry and luxury items being the last things people would snatch up during the pandemic, think again. Though many stores closed during the pandemic, the demand for jewelry has gone unabated for people who can afford it. Whether or not people are conscious of the intricacies of the luxury market relative to the economic climate, we have all heard tales of people who survive difficult times by stashing jewelry and precious stones in their clothing and moving on to a new life. Why do people still consider luxury items such as jewelry, diamond rings, and other luxury items recession-proof? Here are just a few of the reasons why.

Diamonds Have Retained Their Value in the Last 50 Years, Unlike the Dollar

According to an article by Finbold published earlier this year, the value of the dollar has eroded by 86% in the last fifty years. The same cannot be said about diamonds. In a fifty-year trend covering most of the same period, the historical wholesale price of one-carat D-colored diamonds steadily rose to ten times its dollar value between 1960 and 2011. Though so much has been said about the relative abundance of diamonds, a lot of work goes into a gem-quality loose diamond. For instance, most people prefer stones with a length-to-width ratio of around 0.90:1, which looks fatter. These stones tend to fetch a higher price than those with identical weight. Considering the 4 C’s (color, clarity, cut, and carat weight) in diamond valuation, the best quality diamonds from the most reputable dealers do fetch a high price and hold that price quite well even through periods of economic downturn.

High-Carat Diamonds Hold Their Value Best

The prices of diamonds peaked around June 2011. However, unlike diamonds with carat sizes smaller than 1.0 ct, diamonds weighing one carat and above have been resilient. According to the price trend presented by PriceScope.com, after an initial dip during the pandemic, the prices of higher-carat-sized diamonds set new price records by March 2022. One of the most compelling factors that drive these particular sets of diamond sizes is their relative rarity coupled with the unabated demand for such pieces regardless of the economic conditions.

Rare-Color and Very Clear Diamonds Are Highly-Coveted

Perfectly colored diamonds, and more so rare-colored diamonds, fetch a higher price per carat in the diamond market. The price for vivid and intense color diamonds has risen steadily by 10 to 12 percent per year since 1959. Hence investors have been looking at these kinds of diamonds as an asset with a resale value instead of being considered as mere jewels. Because of the current political and economic uncertainty, gem specialists are keen to present rare-colored diamonds as a safer way to hedge against stock, bond, and currency volatility. As for white diamonds, the market for bridal products has been relatively stable despite the economic upheavals.

The Intrinsic Value in Precious Metals, Such As Gold in Jewelry, Appreciates Over Time

Since the end of the Bretton Woods System and the Gold Standard in 1971, the price of gold increased thirty times until it peaked in 2012. The uptrend in the price of gold has since tapered off. However, it outstripped the loss of the dollar's value for the same period better than diamonds have. However, the price of gold gained an uptrend despite the pandemic, topping at $2,000 per oz by July 2020. Gold, after all, has high liquidity and can be sold anywhere in the world at a fair price, and has a steady demand beyond jewelry.

High Luxury Brands and Appraisal From Reputable Sources Help Retain the Value of Your Jewelry

The primary reason branded hard luxury items retain their value is reputation and exclusivity those brands are known for. For instance, a Boucheron emerald necklace would sell at a higher price than a similar item made by an unknown jeweler. This is especially true when it comes to watches. A Patek Philippe Nautilus 5711, though retailing for $30,000, has a waitlist of eight years. Apart from the reputation of the watchmaker and the engineering marvel this watch is reputed to be, these timepieces sell for at least five times this amount in the pre-owned market. For those who can afford it, buying branded hard luxury items now serves as more than a piece of jewelry, it is also an investment instrument.

Conclusion

Diamonds, jewelry, and luxury watches, despite their cost, have been holding their value through the economic downturns of the last few decades. Note that we observed the prices for diamonds and gold over fifty years, starting from the early 70s to the 2020s. We have had many economic downturns and political upheavals within this period, such as the Suez Oil Crisis, the dot-com bubble, the great recession of 2008, and the COVID-19 pandemic, among others. These luxury items, especially if branded hard luxury products or appraised by reputable dealers, are looked at by affluent individuals as a better safe haven than putting more cash in banks or bonds that they see as relatively risky. As people gain more buying power, they also see jewelry, diamonds, and other luxury items as a refuge for their hard-earned wealth.

It is important to note that not all types of jewelry hold their value the same way as other items. The proper guidance and knowledgeable advice from reputed diamonds and luxury product dealers can help you make the right investment choices. Diamond Source NYC has been in the jewelry and luxury watch business for generations, and we can provide the appropriate advice. We have grown our business through our integrity, honesty, and commitment to serving the needs of our clients. Our experienced and reputable appraisers will help you through the process, whether you are looking to buy or sell your jewelry. We assure you that you will always get the best deal possible with us. Visit our store to learn more about jewelry and to view our vast inventory of diamond jewelry and luxury watches. You may also set an appointment for virtual shopping to view your desired piece from anywhere you are in the world.